The main interest rate will continue to develop in the range of 0-0.25 per cent. At this level they persist since December 2008. The decision is in line with the expectations of most economists.

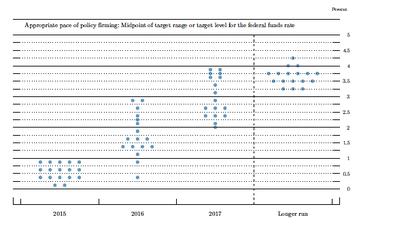

However, the FOMC emphasized its readiness to tighten policy later this year. This does not exclude that it could lead to two increases. The so-called. “Dot-plot” indicates that the median forecasts of FOMC members assumed that reference the federal funds rate will rise to 0.625 percent. by the end of the year. (Click on graphic to enlarge)

Just 2 for 17 members of the committee would like to postpone the decision until 2016.

The Committee expects that it will be appropriate to raise the federal funds rate interval when observed will be further improvement in the labor market and when it is reasonably confident that inflation will return to 2-percent target in the medium term – said in a statement, specifying in this way, “the term” termination of ultraliberal monetary policy and start a cycle of rate hikes.

Observers believe that the Fed at its July meeting still refrains from rate increases and will have to wait until September. For a possible second increase in the FOMC may decide in December.

After a weak first quarter, the FOMC lowered its forecast US GDP growth for the current year. for the current year. He said that at present the economy is growing “at a moderate pace”. In the opinion of the monetary authorities, the labor market recorded steady improvement, while inflation remains low, but stable.

Officials now expect that GDP in 2015. Increase in the range of 1.8 to 2.0 percent. Previous, March estimate assumed meanwhile row 2.3-2.7 per cent range. In 2014. US GDP grew by 2.4 percent.

Stock market investors initially reacted positively to the message of the FOMC. Indices after prior devaluated emerged in the green region. The enthusiasm did not last long and, along with the approaching date of Janet Yellen, the head of the Fed, the mood gradually worsened. Yellen occurrence again breathed optimism among investors about the place resulted in the re-upsurge indicators.

The weakened dollar, in turn, both against the yen and the euro.

No comments:

Post a Comment