The rating agency S & amp; P Global Ratings has announced a maintenance assessment for Polish BBB + with a negative outlook. She pointed to the challenges for public finances in the long run, especially regarding the pension system. In January, the agency downgraded Polish, then the zloty rapidly weakened.

S & amp; P has not changed its rating for Polish, which was lowered half a year ago. In foreign currency, in the short and long-term rating was affirmed at BBB + / A-2, and the national currency at A- / A-2.

“The prospect of negative reflects our view that there is a probability at least one of the three that we can reduce the rating in the next 18 months if weakened the credibility of monetary policy or public finances deteriorate to our current expectations, “- stated in a press release.

Standard & amp; Poor’s in January. long-term rating downgraded Polish debt in foreign currency to the level of “BBB +” from “A-” with a negative outlook. Gold then rapidly weakened.

Elections

ZR & oacute; DLO: Shutterstock S & P downgraded the European Union

Standard & amp; Poor’s (S & amp; P) downgraded on Thursday rating of the European Union … see more »

As reported by the agency, as a result of last year’s parliamentary elections, and thus, changes in the most important state institutions, there are concerns whether the Polish National Bank will remain independent.

” The ratings reflect the relatively low level of income weakened a system of checks and balances between key institutions and the challenges facing the system of finance public, resulting the pension system “- written in the reasons for the decision.

Agency also refers to paralyze the work of the Constitutional Court.

” in our opinion, the changes made in the Polish Constitutional Court continues to make the institution remains virtually paralyzed, “- stressed the S & amp; P. “Despite a procedure to assess the rule of law of the EU and the unfavorable opinion of the Venice Commission, the government has not stepped change” – she added.

questionable Development Plan

S & amp; P also stressed that Poland has a moderate external needs financial Polish and economic potential is strong.

” In our opinion, some of the views of government and activities post-election conflict. For example, while it is planned to increase the national savings rate, introduced solutions to improve consumption, as the program Family 500 plus. therefore, the positive impact of the Plan Morawiecki is the a question mark until will be presented substantiated proposals for action “- added analysts.

S & amp; P predicts that in 2016 economic growth in Poland will amount to 3.5 percent. According to the agency, will be affected by a large domestic demand, as well as the increase in production, supported by exports of goods to Germany. In turn, the budget deficit is expected to be 3 per cent. GDP in the years 2016-2019.

In May, Moody’s retained Polish debt rating at A2 / P-1, but changed the outlook from stable to negative. On the other hand, Fitch is expected to announce its assessment on July 15.

Uncertainty after Brexicie

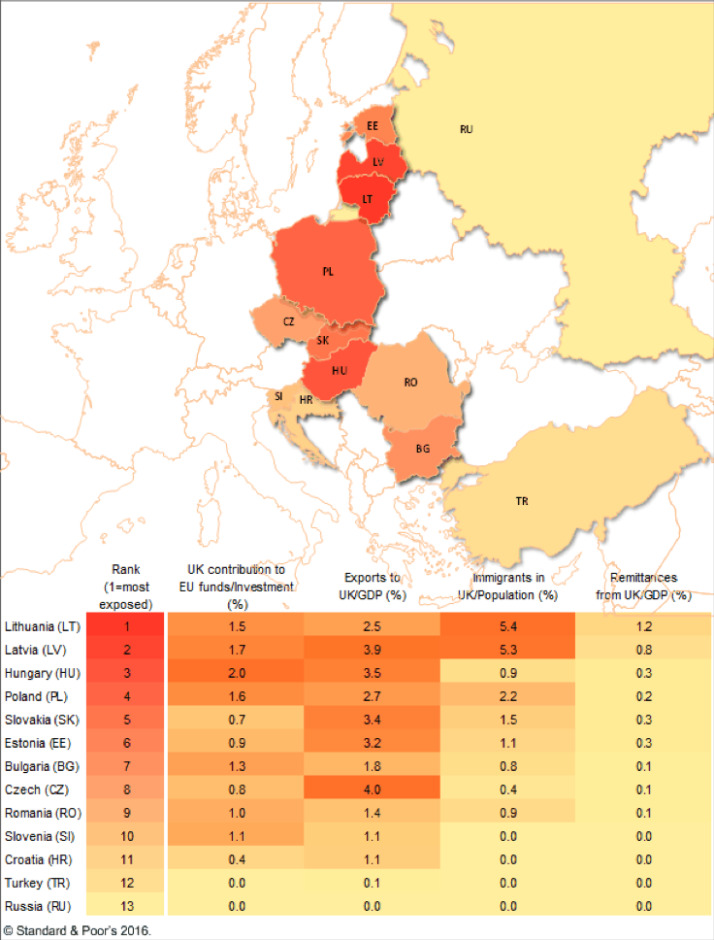

S & amp; P also published a list of countries in Central and Eastern Europe, whose economies are most at risk after Brexicie. Poland found itself in fourth place, after Lithuania, Latvia and Hungary. However, S & amp; P points out that in the case of our country, “by czekuje that the impact Brexitu should be in the near term limited.”

class, specifying the level of influence Brexitu the weakening economies of Central and Eastern Europe Eastern Europe, illustrates the map below:

Source: S & amp; P How Brexit can weaken the economies of Central and Eastern Europe?

S & amp; P and Fitch ratings reduce the UK

No comments:

Post a Comment