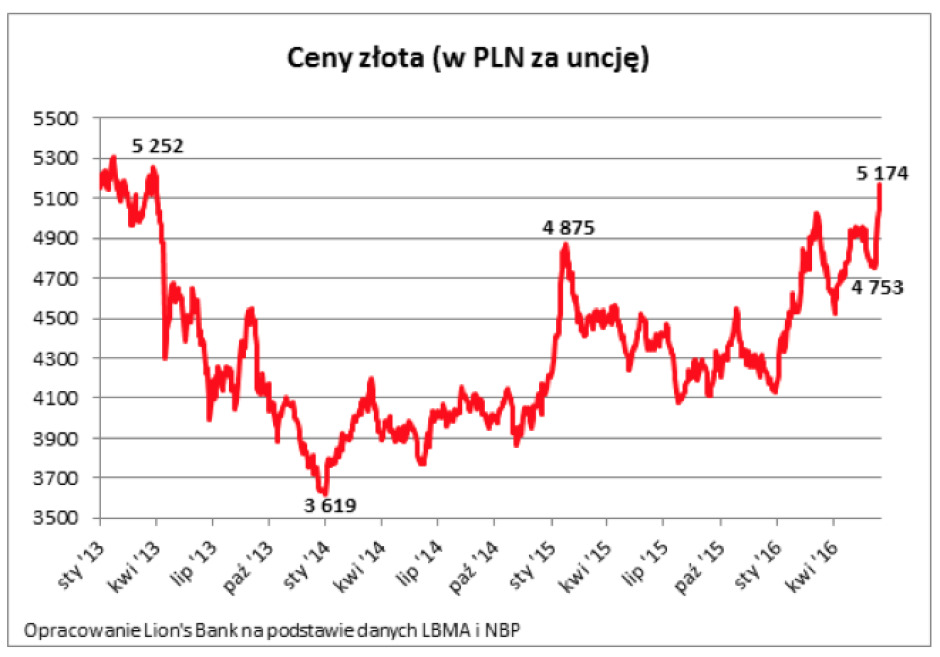

Gold costs highest since 38 months the index kept on the Stock Exchange. On Thursday, the average price of an ounce reached almost 5.3 thousand. zł. According to analysts Lion’s Bank of reasons can be traced to fear Brexitem and the Fed’s decision, despite an earlier announcement, has not decided finally to raise interest rates in the United States.

Fluctuations in the price of gold are very dynamic. Within three weeks ounce first grew cheaper by 200 zł to later become more expensive by 400 zł.

Source: Lion’s Bank Gold prices in PLN

Investors who decide to invest savings in gold, are very sensitive to all kinds of information. Surveys, unofficial rumors, statements of decision-making could cause you to rapidly send orders to buy or sell. ZR & oacute; DLO: Shutterstock fr-zl-bis-16.jpg

Yesterday reflection of the zloty against the major currencies proved to be only a correction. Gro … see more »

The reasons for the ocean

Where are the causes of such sudden fluctuations? Analysts Lion’s Bank suggest that in their quest to look overseas.

The initial statements Janet Yellen of May 27 made the interest rate increases by the Fed seemed more likely. Gold reacted immediately; its price has fallen by 200 zł per ounce.

Such a reaction is rational – the decision to hike rates was to be called a stable condition of the economy and, therefore, less uncertainty in the market.

Dollar currency gold

however, the Fed decided not to change its monetary policy, leaving interest rates unchanged. Such a decision can be interpreted as a lack of improvement of the world’s biggest economy.

In addition, low interest rates involve a weakening of the dollar. This contributed to the growth of quotations of gold of more than 1,300 dollars. per ounce.

This is what the US dollar is the currency in which gold is recorded. Therefore, since cheaper against other currencies, one ounce costs automatically as more dollars. ZR & oacute; DLO: Pixabay.com (CC0) referendum on continued membership in the Union of Great Britain European Union will take place on June 23

No comments:

Post a Comment