Who bought Pekao and how

32.8 per cent. shares of the Bank bought the consortium of the ROM — PFR. The price of 10.6 billion rubles, or 123 rubles per share, of which of 6.46 billion rubles will lay out the insurer. ROM has the money, PFR half of RUB 4.1 billion wants to Finance itself, the rest from external sources (not necessarily the credit in the Bank PKO BP). The consortium will pay for the shares of the Bank in the Russian ruble. Change currency to the Euro should take place outside the market via BGK and the BANK. In the hands of the UniCredit group will be 7 percent. Lock up is 3 years. The Italians have already begun to emit debt securities convertible into shares of Pekao.

we’ve written PB 23.06.2016 >> Pekao can be make

Banking magnate, i.e. Pekao in numbers

the Share of the banking market: 11%.

Number of employees: 16,1 thousand UAH.

Assets: 163,2 billion rubles.

the Number of current accounts: 5 377 thousand.

Number of seats: 947

the Number of ATMs 1 754

What the deal means for:

CTP

the Purchase of shares of Bank Pekao via ROM will be felt not only in the banking sector but also in insurance. First of all, PZU will have access to 5 million customers of the Bank, who will want him as the largest shareholder to offer its products. First can quickly appear in the Windows of Pekao. In February it was reported that the Bank launched a competition for a new provider of insurance products. To take part in it the previous two: Allianz and Ergo Hestia and Aviva. Given the sale process of the Bank, the contest was extended until the end of February and, most likely, don’t expect his decision. This means that the ROM will be facilitated entrance of the Bank. Pekao is also a leading player in the segment of services for corporate clients — investment funds the largest private and public companies in Poland. It is a valuable asset for the insurer, which has focused on expansion in the corporate segment. For dependent rate TUW PZUW carries out actions aimed at R 20;repolonizacji insurance”, that is, to insure major state-owned companies, which previously often use the services of companies, owned by foreign owners. [MGA]

Pekao

the Long-term consequences for Pekao can be significant. Most likely will be a division of roles: PKO BP will retail (supports 7 million customers), and Pekao market, which today is the largest player. Employees rather, you can sleep peacefully because there are no reasons why the Bank needs to reduce the employment. For retail customers, and especially for the company this is good news, because repolonizacja means a loss of competitiveness. Pekao very serious rywalizowało with PKO BP except some business considerations also played questions, personal and personal ambitions menedżmentów. The advantage for retail customers is the fact that Pekao is likely to quickly join the mobile payment platform Blik, which will significantly increase the range and usefulness of the system. Changes in Pekao will be visible to the naked eye in the near future. In accordance with the agreement the Bank within six months must undergo a rebranding. It is not known what the logo will disappear onl y red one, the identification mark of Unicredit group, will change the name. The Italians tried several times to repaint the sign on the Bank’s, but research indicated that customers are not distinguished Pekao and PKO BP, at the end of the day, it is useful to first Bank.

Who else will fall under the wing of the ing Bank śląski

Bank Pekao or directly into the ROM can buy from the Unicredit group missing 51 percent. share, Pioneer Pekao IM (same for Pioneer Pekao TFI, whose assets are of 16.8 billion rubles), 35%. Pekao PTE, the Manager of the pension Fund of UAH 2.16 billion of assets and 50 percent. shares in the consulting company Xelion. The parties agreed that the maximum price for these assets is not more than 634 million UAH. After taking control of the ROM will find number 1 on the market means the capital market (TFI PZU has assets net worth of 21.2 billion rubles) and No. 3 (Pioneer Pekao TFI). With joint assets at 38 billion rubles will be a legal entity, which is two times more than number two in this part of the market — PKO TFI. TFI PZU manages also funds the private market about the assets of 7.2 billion pounds (5. position in the market, the absolute leader is Ipopema TFI). Pekao. and is a legal entity, which has the smallest, only 1.5% market share, which is currently 12 companies. US R OM Golden Autumn has assets valued at 19.1 billion rubles (13 per cent. of the total volume). More have only Aviva (32.2 billion rubles) and Nationale-Nederlanden (36.2 billion rubles). [KZ]

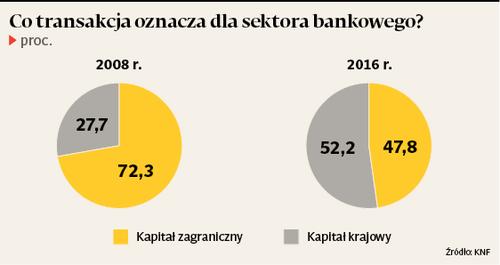

Repolonizacja

connect with Pekao PKO BP

Representatives of the buyer consortium will ask the “Pulse of Business” for this opportunity in accordance denied, saying that the merger is unprofitable from the point of view of business and customers. It seems, however, that this scenario is not possible so that, ultimately, it is very likely. The banking sector is strengthening across Europe, because the very low legs, moderate lending about efficiency determines the scale of the activity and the strength of the balance sheet. PKO — bank Pekao s. a. with assets of 280 billion (62 billion EUROS) is not included even in the top 50 largest banks in Europe. It is also only 1/7 of the GDP of Poland. For comparison, BNP Paribas has a balance of the GDP of France. If czempiony banking should play an important role, in addition to the Polish market, without connecting forces on foreign travelers do not have that dream. Merger of banks is highly problematic from a social point of view, since the connection would lead to huge layoffs. Both the “pekao” work 45 thousand. people, of which a large part of the network, in the local markets.

No comments:

Post a Comment