At the beginning of the session on Thursday, the odds of banks, most strongly involved in mortgages in CHF fell on at least 4 percent.

terribly under the line were Getin Noble Bank and Millennium Stadium.

Status from the chair. 10:00

According to the key amendment, tabled by the SLD, the bank has to redeem 9/10 of the difference between the value of the loan after conversion and the amount of debt, we would have at this point the borrower had in the past entered into an agreement with a bank for a loan in Polish zloty, and not in a foreign currency.

– In the original proposal, the bank had to redeem half of this amount. Still conversion will be possible until 2020 and only for customers with an LTV above 80% (over 120% in the first year, 100-120% in the second and above 80% in subsequent years) – notes Maciej Marcinowski, an analyst Trigon DM.

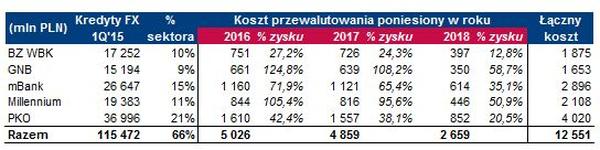

– Increase the proportion of umarzanej part of the loan at the expense of the banks clearly increases the potential losses for the sector since the conversion becomes cost effective for a larger group of borrowers. The original project was cost-effective only for loans in the second and third quarter of 2008 for the CHF / PLN below 2.15. Currently, this should be beneficial for clients who took credit in 2007 or 2008 at the rate of CHF / PLN below 2.50. Without taking into account any restrictions should apply for conversion of CHF loans worth about 92 billion zł, and potential damage to the sector would be around 32 billion zł. However, we assume that the restriction on LTV will reduce the number of eligible clients by 20%, and the criterion surface and having a second housing by a further 20%. So eventually we estimate that the cost to the sector may total about 19 billion zł and will be spread over three years – calculated by Maciej Marcinowski.

The WIG Banks, even before Thursday reduced prices, was 17 percent. lower than in May, this year’s summit.

No comments:

Post a Comment