apartment for Young gain

Larger requirements for own contribution will increase interest in the program for Young Living that will help people without access to cash loan. At the same time, the program will encourage buyers to take advantage of the offer developers, because funding can only get by buying the property from the primary market. To benefit from funding are eligible people buying their first apartment satisfying the conditions of the Act, inter alia, the price and size of the property.

Developers will be more to build

In 2013. Developers began relatively few sites, as a result you can expect a smaller number of completed dwellings in 2015. because construction usually takes about two years. We expect to see further growth in housing starts, as indicated by a lot of building permits issued in recent months. Good sales results in 2014. (Most companies significantly improved results) allow developers to look optimistically to the future. The conducted by the Home Broker survey revealed that lower rates for the apartment, we can only count the time due to the recent promotion or sale of apartments in the project. 56 per cent. interviewed the developers planned in 2015. introduce price changes in the currently marketed investments or their next steps. Every fourth developer is considering raising rates, and one in five has them already planned.

Sale of loans Housing unchanged

The first three quarters of this year in terms of sales were mortgage weaker than the same period of 2013. by 1 percent. We expect that this trend will continue, and this is due, inter alia, increase in the minimum level of own contribution. 10 percent. required from 1 January 2015. impede some customers taking out a loan to buy a home. On the plus side, in turn, will affect low interest rates. As a result, the value of sales in 2015. Housing loans will be similar or slightly lower than in 2014.

The expected interest rate cut

Quotations contracts, forward rate agreements (FRA) indicate that the market expects interest rate cuts in the first half of the year. It should further inflate record low levels WIBOR, which are base mortgage rate. But the new borrower benefit from this only partially, and this is due to the gently rising credit spreads. So they get a lower interest rate loan, but not so much as drop foot.

Prices flats – general stabilization of hesitations

A dozen months of stabilization in housing prices in the country is unheard of years on the Polish market for a sense of security. The beginning of 2015. May, however, be associated with periodic fluctuations in prices, for which they will become more demanding as the own contribution. From 1 January 2015. Buying an apartment on credit will need to have at least 10 percent. Cash (in 2014. it was a 5 per cent.). It must be remembered that the own contribution is not only money, which the buyer needs. After adding a commission for the agent, at the notary fees, taxes and other costs out that buying an apartment for 200 thousand. zł in the secondary market you will need to have the amount of over 40 thousand. zł (20 per cent. of the apartment). In the primary market do not pay tax on civil law, and many brokers do not charge commission for the purchase of apartments from the developer, in this situation enough so approx. 33 thousand. zł (16.5 per cent. of the apartment). This can lead to a slight decrease in the number of applicants for housing and, in effect, temporarily lower the price by a few percent.

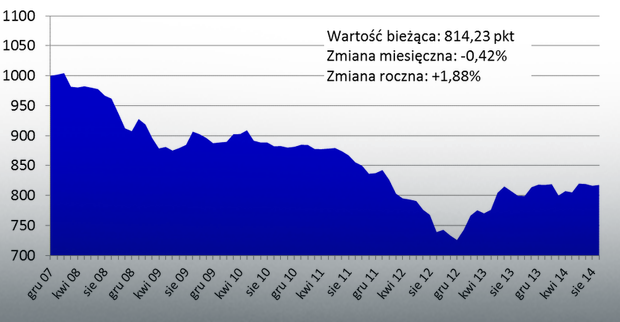

Home Price Index Transaction Broker and Open Finance

Source: Home Broker and Open Finance; based on customer transactions carried out by companies.

The market will need a few months to get used to the new situation and after the winter reduction should return to stability. It speaks for balancing the forces acting on the rise or fall in price. Stimulating the demand side will be affected by, among others, Program availability Apartment for Young, who facilitates the purchase of people without sufficient own contribution (still waiting for the amendment of the Act) and the low interest rates and attractive interest rates on loans. On the other side of the market affected include economic uncertainty, increasing supply (by three quarters of 2014. developers launched for sale in six major markets around 45 thousand. units) and higher required own contribution.

Prices for apartments in cities dependent on the specifications of the local market

In each urban real estate prices affected by other factors than the market nationwide. At stake, among others, the specifics of the market and the program for Young Living. In the cities where the program is readily available it leads to higher prices in the primary market, in turn, where about housing in MdM is difficult, you can count on lower prices of developers. It is worth noting that smaller price fluctuations observed in the largest cities (Gdańsk, Krakow, Poznan, Wroclaw and Warsaw), this is due to the specification of statistics – where the transaction is carried out less expensive or the effects of several investment cheaper average price is just higher than in agglomerations, where it sells more homes.

The average price per square meter of housing in major Polish cities and their change over time

| City | The median price per sqm. | Changing Prices y / y |

| Bialystok | 4 088 zł | 3.8% |

| Bydgoszcz | 4 194 zł | 7.9% |

| Gdańsk | 5 131 zł | 0.5% |

| Katowice | 3 zł 842 | -5.2% |

| Krakow | 6 zł 009 | 1.5% |

| Lublin | 4 316 zł | -8.2% |

| boat | 3 zł 613 | 2.0% |

| Olsztyn | 4 279 zł | 1.4% |

| Poznań | 5 zł 391 | 0.4% |

| Szczecin | 4 273 zł | 0.1% |

| Warsaw | 7 239 zł | 1.0% |

| Wroclaw | 5 zł 484 | 1.0% |

Source: Home Broker and Open Finance; based on customer transactions carried out by companies.

No comments:

Post a Comment