Source: Bloomberg

Source: Parkiet

Source: Parkiet

The Sejm decided that banks will incur 90 per cent., not 50 per cent., as previously planned, the cost of conversion loans frankowych. In total, it may cost 19 instead of 9 billion zł.

Thursday’s session on the Warsaw Stock Exchange for listed banks began with the meltdown courses and most of them dropped a few percent. Just before noon, it was even worse. Share price Getin Noble Bank fell as much as 28.8 per cent., Bank Millennium by 17.9 per cent., While mBank by 12.6 percent. (Their quotations were temporarily suspended). PKO BP, the largest Polish bank, got cheaper by 11.1 percent. (The fifth biggest drop in history), while BZ WBK, the third largest bank on the market, by 8.3 percent. All have large exposure to mortgages in Swiss francs. But also fell courses are independent of banks francs – Alior, Pekao and Trade.

Rising costs for this sector

On Wednesday evening, the Parliament passed a law conversion mortgages in francs proposed PO, but heavily modified amendments SLD. The bank has to absorb losses, the difference between the loan in Swiss francs and gold hypothetical loan of up to 90 percent. (Before it was to be 50 per cent.). – Increasing the proportion of umarzanej part of the loan at the expense of the banks clearly increases the potential losses for the sector since the conversion becomes cost effective for a larger group of borrowers, even those taking a loan at a rate below 2.5 CHF / PLN – says Maciej Marcinowski, an analyst Trigon DM. Previously it was assumed that opt for conversion, customers taking a loan at a rate below 2.15. Trigona Estimates show that the potential cost of operations for the banking sector to the original proposal will increase to 19 billion zł from 9 billion zł.

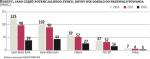

Trigon assumes that this cost will be spread across three years in the proportion of 40-39-21 percent. – Relatively hardest hit GNB and the Millennium, and the least BZ WBK. In the case of GNB cost of conversion may exceed the bank’s annual profit before taking into account the bank tax, so there is a high risk of the share issue. We believe that if the bill passes the Senate, the new president will sign it – adds Marcinowski.

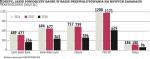

According to analysts, DM BZ WBK most at risk are currency conversion Getin Noble Bank (to 9 per cent. Share in the mortgage market frankowych) Millennium (13 percent.), mBank (15 percent.) and PKO BP (23 percent.). In the case of GNB loss on this account in 2016. May be as high as 125 percent. the projected profit of the bank in 2016. without considering the conversion. It may cost GNB in the years 2016-2018 respectively zł 489 million, 477 million and 256 million zł zł. In the case of the Millennium loss suffered by the conversion can in 2016. Reach 102 percent. profits, if there were no conversion. Trash this operation for the bank is estimated at 694 million zł, 677 zł million zł and 363 million in the years 2016-2018. On the other hand, mBank conversion may be 59 percent. profit in 2016. Cost for the period 2016-2018 is 757 million zł, 739 zł million and 396 million zł. In the case of PKO BP, the largest Polish bank, Franková operation will consume 37 percent. profit in 2016., and the total cost over three years will reach 3 billion zł.

Solvency preserved

Krzysztof Rosinski, CEO of GNB, recalls that the portfolio of loans in francs, the bank is approx. 3.7 billion francs, but the initial calculations show that the conversion are entitled to buyers with loans worth a third of that amount. – Addition of 5-10 per cent. This group took credit at the rate of more than 2.5 zł, so rather not raised. We assumed that report 90 percent. this group and possible conversion loans will be totaled approximately CHF 1 billion – explains.

Indicates that GNB consolidated capital adequacy ratios at the end of the first half, assuming the results anticipated by analysts, would amount to 13 percent. (Combined) and 10 per cent. (Tier1). – So to 8 per cent., Required by law in the case of the consolidated rate, we still have a buffer of about 1 billion zł, and additionally indicators improve net profit for the third quarter. On this basis, we estimate that our statutory capital adequacy ratios should not be exceeded. Although KNF expects rates at 12 percent. and 9 per cent., in case of problems will perform to the FSA for the transitional period and will be counted profits from subsequent quarters to equity. We also have the opportunity to sell some assets and we will do it depending on the pace and number of applicants to customers. For now, we do not think about the issue of shares – said Rosinski.

No comments:

Post a Comment